Tracking the Performance of JP Morgan Stock: A Comprehensive Guide

BlogTable of Contents

- Trade of the Day: Fading the Rally in JPMorgan Chase Stock | InvestorPlace

- 3 Large-Cap Stocks to Buy After Earnings: JPM, NFLX and KMI | Markets ...

- Tổng quan về cổ phiếu JPM: Tất cả những điều bạn cần biết về JPMorgan ...

- Is JPMorgan Chase Stock (JPM) Still A Good Buy After Rally? | Seeking Alpha

- JPM Stock Looks like a Great Buy, but It Just Can't Get Traction ...

- JPMorgan Chase | $JPM Stock | Shares Rise Marginally On Q3 Earnings ...

- JPM Stock Price and Chart — TradingView

- JPM Stock Price and Chart — NYSE:JPM — TradingView

- JPM Stock: JPMorgan Stock Is Its Most Oversold Since 2009 | InvestorPlace

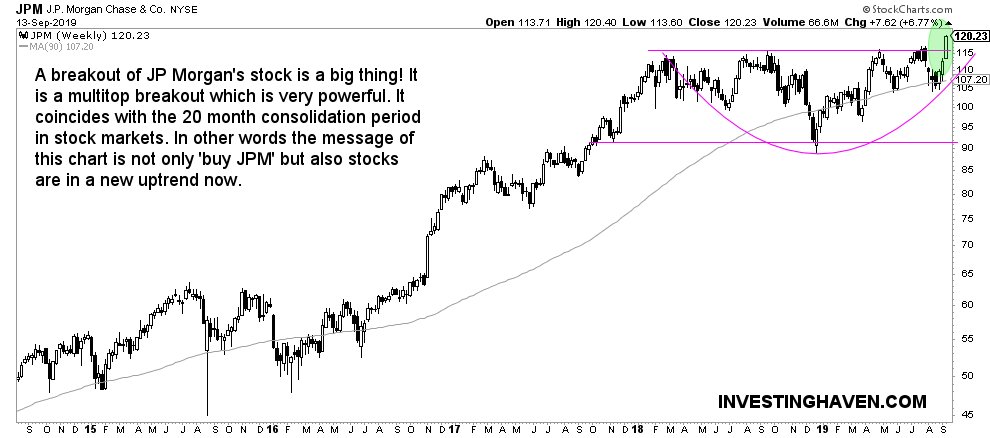

- Is JP Morgan's (JPM) Stock Bullish Going Into 2020? - InvestingHaven

Current JPM Stock Price

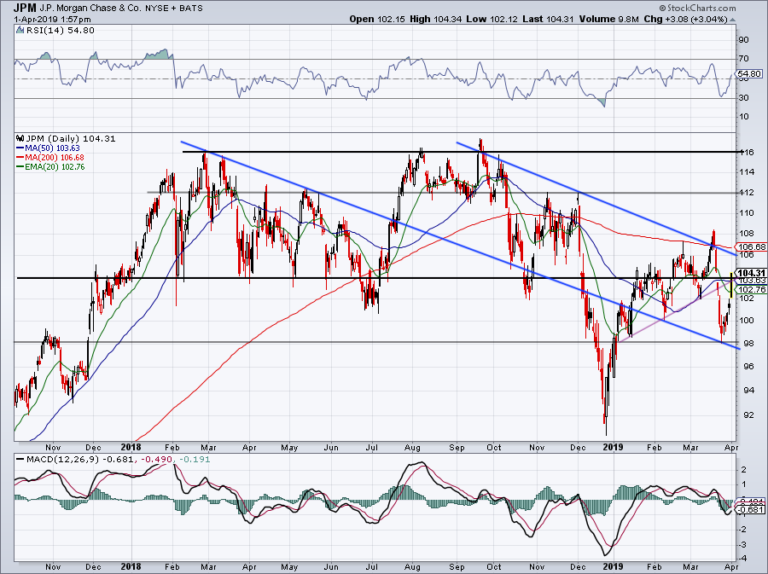

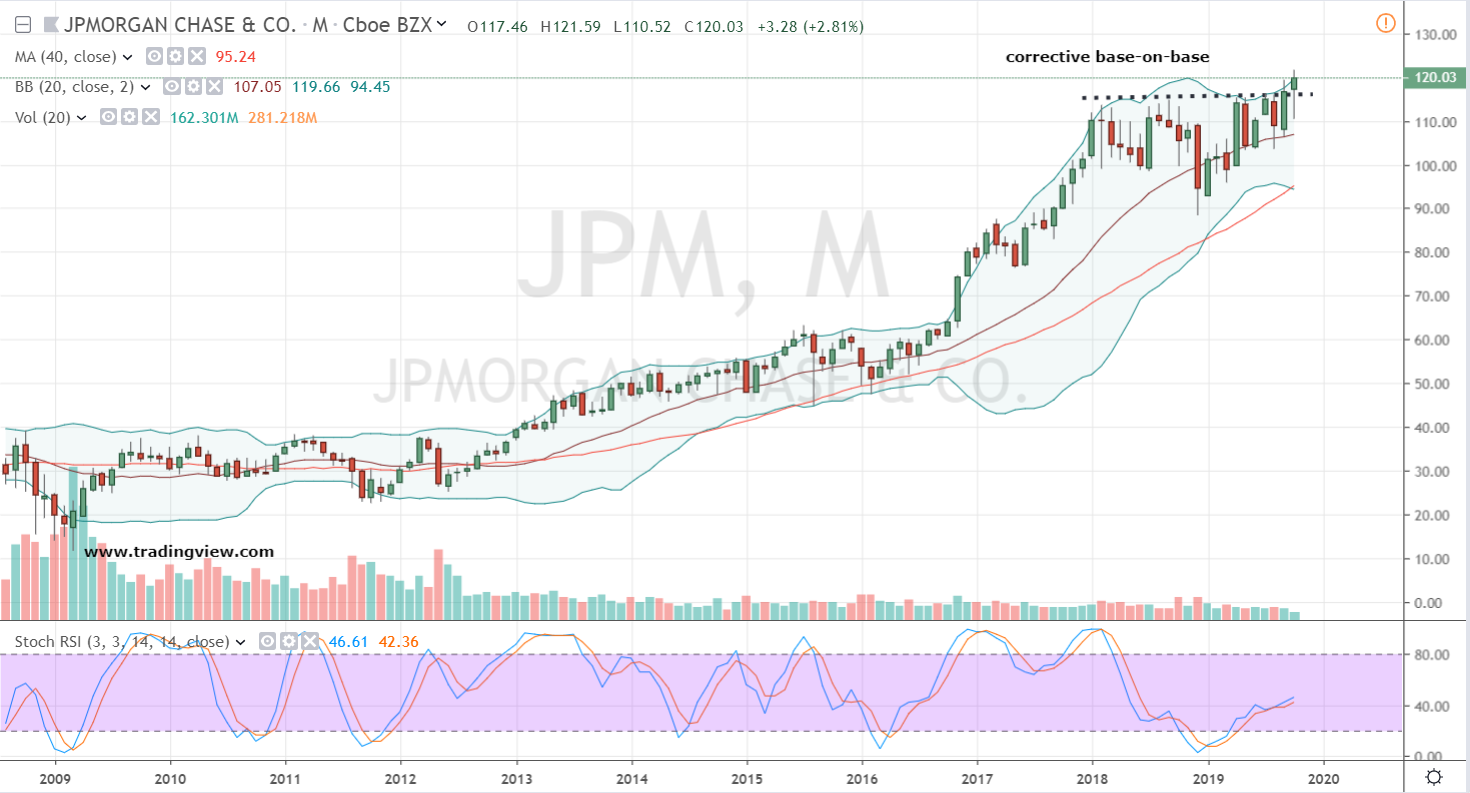

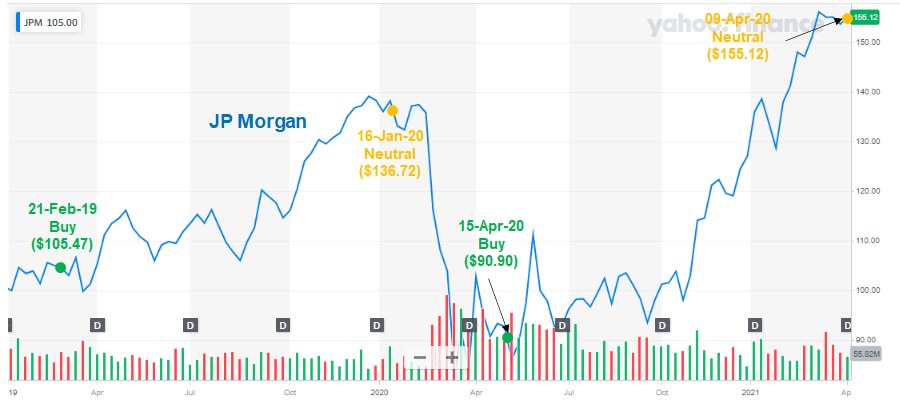

Historical Performance

Morningstar Analysis

Morningstar provides in-depth analysis and research on JPMorgan Chase & Co., including its stock price, financial performance, and competitive position. According to Morningstar, JPM has a strong economic moat, with a wide range of financial services and a large customer base. The company's diversified business model, which includes consumer and community banking, corporate and investment banking, and asset management, helps to reduce its risk profile and increase its potential for long-term growth. Morningstar also provides a detailed breakdown of JPM's financial performance, including its revenue, net income, and return on equity. The company's financials are impressive, with a return on equity of over 15% and a net income of over $30 billion in the latest fiscal year.

Factors Affecting JPM Stock Price

The JPM stock price is affected by a range of factors, including: Economic conditions: The overall health of the economy, including interest rates, inflation, and employment rates, can impact JPM's financial performance and stock price. Regulatory environment: Changes in financial regulations, such as the Dodd-Frank Act, can impact JPM's business model and profitability. Competition: The financial sector is highly competitive, and JPM faces competition from other large banks, such as Bank of America and Wells Fargo. Company-specific events: Events such as mergers and acquisitions, changes in leadership, and major financial transactions can impact JPM's stock price. In conclusion, the JPM stock price is a closely watched indicator of the financial sector's performance and the overall health of the economy. With its strong financial performance, diversified business model, and wide range of financial services, JPMorgan Chase & Co. is a popular choice among investors seeking long-term growth and stability. By tracking the JPM stock price and staying up-to-date with the latest analysis and research from Morningstar, investors can make informed decisions about their investment portfolios.For more information on JPMorgan Chase & Co. and its stock price, visit the Morningstar website or consult with a financial advisor.